Board of Directors: A Comprehensive Guide for Founders

by Greg Miaskiewicz • 15 min readpublished May 27, 2021 • updated December 4, 2023

by Greg Miaskiewicz • 15 min readpublished May 27, 2021 • updated December 4, 2023

How do you choose your board of directors?

When you incorporate on Capbase, and create a Delaware corporation, the first thing you'll do is designate your board of directors. Be careful, this is your most important decision, as the board hires and fires the CEO of the company. Board control is one of the biggest issues for founders as companies grow.

Read on to learn:

- What does a board of directors do

- Who sits on the board of directors

- How a board of directors develops through funding rounds

- How Capbase helps you manage your board of directors

What is a Board of Directors?

Your board of directors is the interface between the shareholders in your company, and the management of the company. Early on, these seats will all be filled by founders, but it's important to jealously guard your board and make sure that it moves the company forward how you and your co-founders want it to move.

Directors have what is called a “fiduciary responsibility” to the shareholders. This means that they must act in the best interest of the shareholders. This has nothing to do with the best interests of the founders, or of the current CEO, officers, or board members, but solely to do with the best interests of the shareholders.

If the board believes that it is in the best interest of the shareholders to change the management of the company, they must vote to do so, regardless of their personal desires or loyalties. It is always important to keep this fiduciary responsibility in mind when contemplating your board.

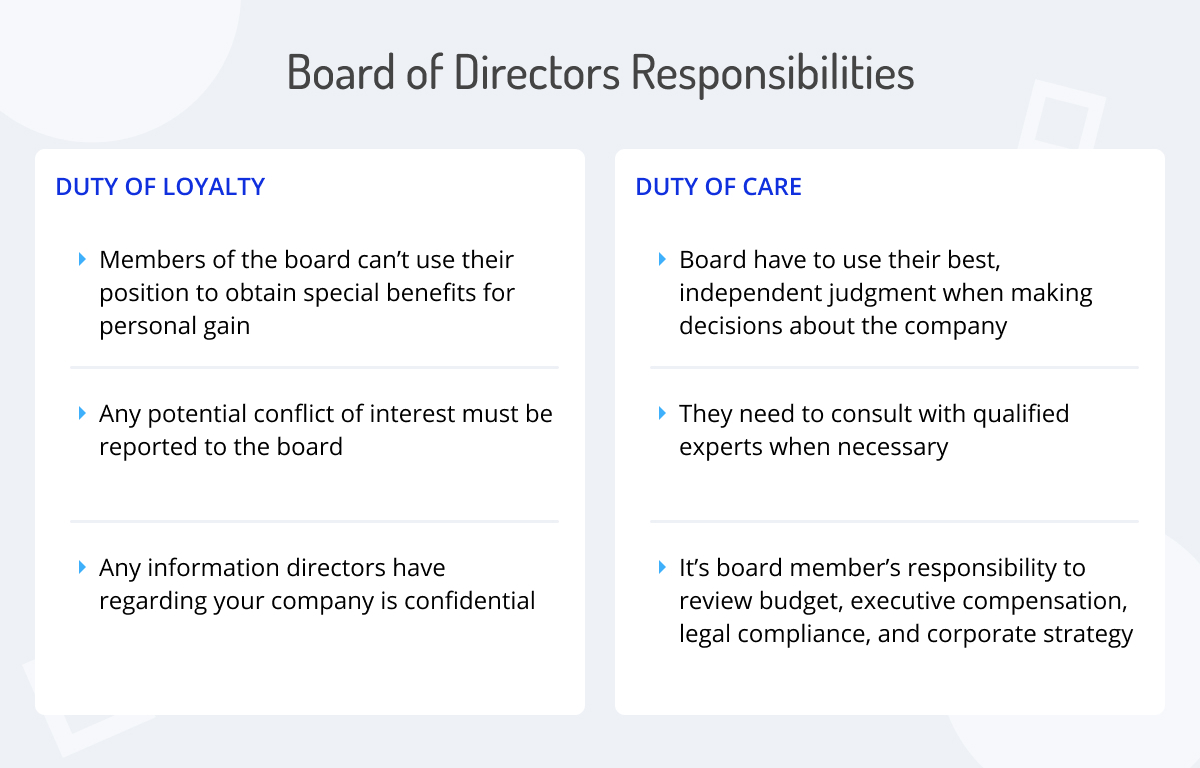

The Responsibilities of the Board to the Company

Board members have two legal responsibilities when it comes to dealing with the companies that they help to direct.

- Duty of loyalty

- Duty of care

Both of these duties really boil down to the fact that directors must act in the best interest of the company, at all times. And by company, we mean the shareholders. Members of your board of directors must be free of conflicts of interest, they must not put their own interests above those of the shareholders, nor must they confuse the duties that they may have to other boards they sit on.

The Responsibilities of the Company to the Board

The company must also protect the board members from frivolous lawsuits that may be brought by disgruntled shareholders, employees, or customers.

This is most frequently done with an indemnification agreement, in which the company agrees to take on any lawsuits and protect the members of the board in any such case. This agreement between a new board member and the company is automatically generated for you by Capbase when a new member joins your board.

This risk can then be further defrayed by the company by retaining insurance for directors and officers, commonly called D&O insurance (we partnered up with Vouch to help you out with this).

Board of Directors vs Board of Advisors - What’s the difference?

If you’re ever asking the question, “should I add this person to my board of directors,” then the answer is almost certainly, “no, they should be on your board of advisors.” It’s a question that can trip up first time founders fairly frequently.

- Your board of directors is the single most vital piece of control in your startup.

- The board of advisors is a more informal group whose job is to help the founders navigate early tasks. Find out more about who you should have on your advisory board.

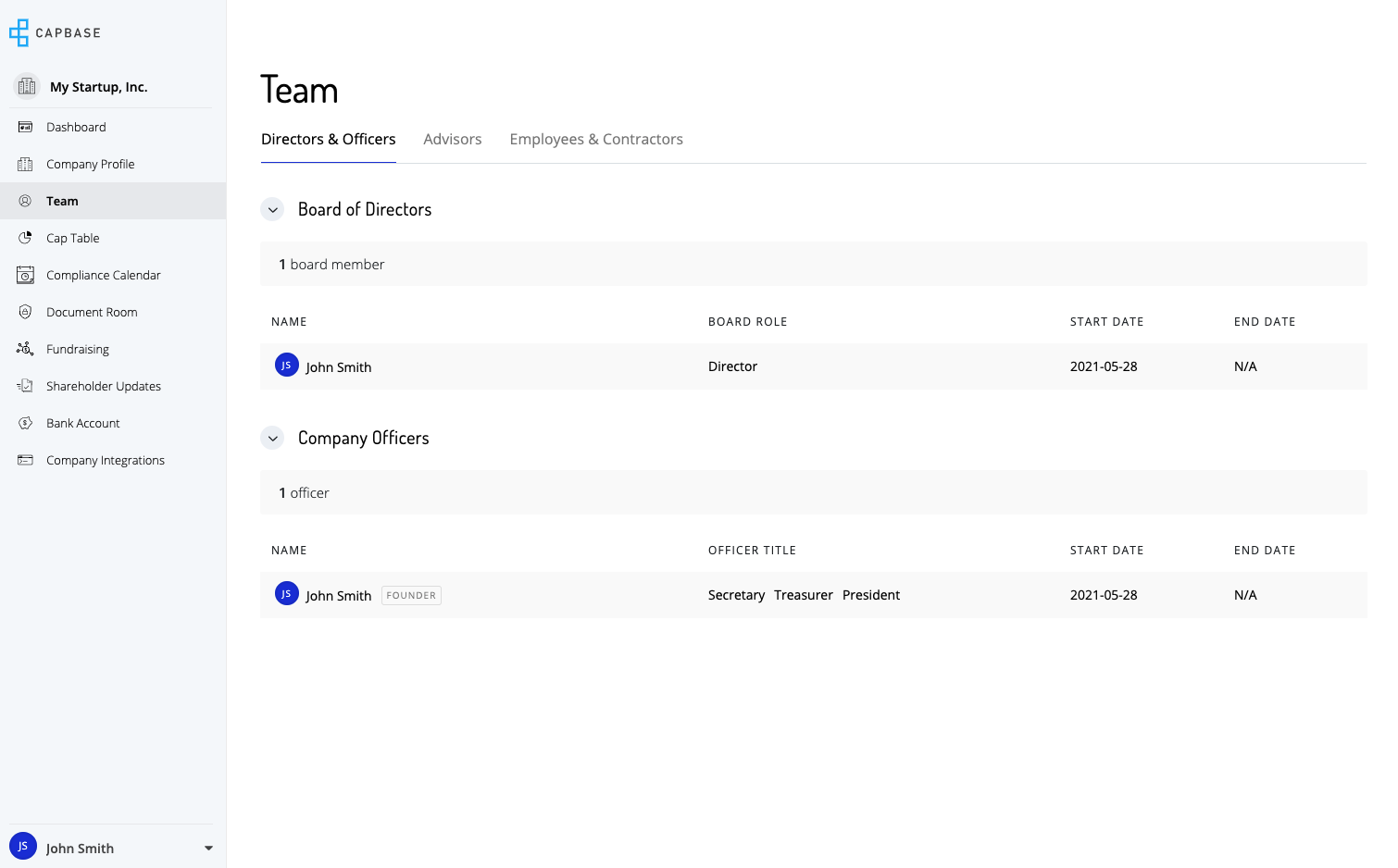

When you manage your company on Capbase, it’s always easy to see the makeup of your board of directors and your board of advisors in the Team section of your dashboard.

Who sits on a board of directors?

Who sits on a board of directors will change as a company grows. At formation, it’s just the founders. As you take on investors, you’ll occasionally add them to your board. As your board grows with investors, you’ll also add independent board members to balance the interests of the cofounders with those of the investors.

Insider Board Members

Insiders are considered members of the company management, company founders, and company friends. They are an important bloc on the board, as they should be primarily representing the interests of the founding shareholders. At the beginning of the company, this will be the only shareholders, and will be the only group on the board.

Investor Board Members

As you take on investments, you will gain shareholders who are outside of the common shareholders (your founders, your advisors, and any other employees or contractors). These investors will comprise multiple shareholder classes, and it is only natural that these classes will want representation on the company’s board.

The earlier you are in the process, and the less of the company the investors hold, the smaller their presence will be on the board of directors. It’s not uncommon for investors to ask for one (or more) seats on your board as a condition of their investment in your company. The more competitive your round is, and the more firms you have bidding for a piece of your company, the more control you will be able to keep.

If you are raising money, and you already have investor representation on your board, one level available to you is to ask the various investor classes to combine their board representation. This won’t always work, as the Series Seed investors will have slightly different interests than the Series A investors, but, depending on your leverage, and the current size of your board, you can likely work with investors to come up with a creative solution.

Independent Board Members

When you’re adding investor board members, it’s also a good idea to add independent board members. These are commonly other founders or CEOs who can be helpful to your company, either in making significant customer or investor connections. These members are typically agreeable to all shareholders, and are commonly compensated for their time, with equity in the case of growth startup, and with an increasing portion of cash as well as equity as the startup moves from pure growth and begins to build real enterprise value.

Independent board members can help to balance the interests of the investors with the interests of the common shareholders, but do not mistake them for your allies, or for people always in your corner. Their duty is to all shareholders, not to the shareholders in any particular class.

How do I add someone to my board?

The process of adding new members to a board of directors is determined by the bylaws and may differ from corporation to corporation. Typically the board of directors votes to approve any new members during a board meeting. If the motion passes, you need to add an amendment to your corporation’s articles of incorporation.

With Capbase managing your board and your board of advisors is simple. You can add and remove members, change their cash or equity compensation, handle indemnification, and everything else your startup needs right from your capbase.com dashboard.

How your board of directors develops through funding rounds?

Your board of directors will change over time as your startup secures new funding. That’s because you’ll want to give investors a place on the board. Here are the stages your board will go through, based on the experience of entrepreneur and venture capitalist Mark Suster.

Your board of directors at the seed round

During the seed round, investors may request a seat on your board. As a founder, you have the right to grant or politely decline this request.

Your decision should be based on:

- The amount the investor has put into your company. If the check they wrote covers 75% of your funding round, they’re a more likely board member than if they only covered 10%

- Competition from other investors—you can afford to be picky when you have many sources of funding

- How helpful you expect the investor to be—whether their experience and connections will help with later rounds of funding

It is usually wise, this early in your company’s funding, to retain founder control. That means the majority of shares are in founders’ hands, and founders play a significant role on the board.

Your board of directors at Series A

Venture capital firms investing in your company at Series A will in all likelihood require they be granted a seat on the board. Unless you have a very competitive round, with many VCs, you should grant their request. It’s normal. And, if you’re willing to take money from a VC, but don’t trust them to act on your board, it’s worth, before signing anything, to ask yourself why.

It’s common for founders to retain control of the board at the A round, at a ratio of 2:1 or 3:2 founders:investors. In the latter case, typically two founders will sit on the board, with a third appointed by the majority of common (as opposed to preferred) shareholders. However, having three founders on the board can become complicated.

Your board of directors at Series B

You may be able to retain founder control at Series B at a ratio of 3:2, where “2” is two different VC firms.

More likely, your investors will want your board to be less founder-controlled, without necessarily demanding they control it themselves. That’s where independent board members come in.

Independent board members are neither founders nor investors; they typically come from an outside business (meaning they have to take special precautions to avoid any conflict of interest). Also, they’re typically compensated in shares. It’s their role to act, more or less, as a neutral party, a power broker between founders and investors.

As well as maintaining a balance of power, independent board members can also offer valuable startup and leadership experience, or fulfill mentorship roles. And because they’re compensated with equity, they have “skin in the game,” so to speak. More on independent board members shortly.

Your board of directors at Series C

It’s very unlikely you, as the founder, will be able to retain board control through Series C funding. But that’s okay.

By Series C, new VCs are putting enough money into your company that they expect representation on the board. And VCs from earlier rounds are under pressure from their backers, their limited partners (LPs), to put their money to work.

It’s common at this stage for the board’s ratio to be 3:2 or 4:1 investors:founders. But that doesn’t necessarily mean your investors are going to move in, fire your CEO, and install someone new.

Investors in Series A and Series B likely put money into your company because they had faith that your leadership—your CEO, at least—would be a good leader and take the company where it needed to go to succeed. In that case, they don’t want to see your CEO suddenly replaced by new investors.

The best thing your CEO can do now is do their work well and remain popular.

However, at this point, as a founder, you may be ready to leave the board. In that case, it’s best to work with the board to find your replacement, and exit gracefully. The focus of a startup changes over time—from inspiration and vision to team management and operations. Some founders are better at the earlier stages than the latter.

Ready to start courting potential investors? Capbase gives you all the due diligence records you need.

Summary

- Your board of directors is the interface between the shareholders in your company, and the management of the company.

- Board of directors is elected to represent the interests of the company and make decisions regarding policies, compensation and recruitment of upper level management

- Board of directors initially consists of company founders and as it grows investor and independent board members are added

- Capbase lets you designate your board of directors, add and remove members, change their cash or equity compensation, and handle indemnification agreements

RELATED

Who Do I Need on My Advisory Board?

Learn more about how advisors help startups. We cover typical advisory agreements, share grants and how to get the most out of your relationship with advisors.

Written by Greg Miaskiewicz

Security expert, product designer & serial entrepreneur. Sold previous startup to Integral Ad Science in 2016, where he led a fraud R&D team leading up to a $850M+ purchase by Vista in 2018.

Related

9 Common Legal Mistakes Made By Startups and How To Avoid Them

Avoid these common legal mistakes made by startups and save your company from dealing with fines and lawsuits. As a startup founder, keeping your company compliant is essential to protecting the value of your startup equity and reaping the rewards of your hard work.

by Greg Miaskiewicz • 7 min read

by Greg Miaskiewicz • 7 min readWhat is an LLC and Why Choose it for Your Business?

Discover why an LLC is a smart choice for your business: offering personal liability protection, tax efficiency, and operational ease, it's ideal for entrepreneurs seeking a balance between security and flexibility.

by Michał Kowalewski • 7 min read

by Michał Kowalewski • 7 min readNDAs & MNDAs in Startups: How to Protect Your Ideas And Relationships

Explore the importance of NDAs and MNDAs in startups, their purpose in safeguarding intellectual property and sensitive information, and essential elements for effective agreements. Learn how to protect your startup and ensure its success.

by Michał Kowalewski • 7 min read

by Michał Kowalewski • 7 min read