Startups and their financial journeys are as varied and unique as the entrepreneurs behind them. Yet, one universal truth remains: raising capital is vital to transforming a burgeoning idea into a viable business.

Among the different financing options available, Bridge Round Financing plays a particularly significant role, often providing the crucial lifeline that startups need to traverse uncertain times.

As the name suggests, this financing option serves as a "bridge," enabling startups to transition from one funding stage to another smoothly and, sometimes, ensuring their survival when things don't go as planned. Understanding bridge round financing can be the key to successfully navigating the turbulent waters of startup financing.

This comprehensive guide will delve into the depths of bridge round financing, highlighting its role, process, and importance in startup funding.

Key Takeaways

- Lifeline for Startups: Bridge financing helps startups navigate funding gaps and continue operations during uncertain times.

- Unique Mechanism: It involves convertible notes or SAFE agreements, letting startups secure funds without setting a specific valuation.

- Balancing Act: Startups must weigh the advantages and drawbacks of bridge financing, including potential ownership dilution and signaling to future investors.

What is Bridge Round Financing?

Bridge round financing is interim funding designed to sustain a startup's operations until its next significant financing round. In a venture capital world where businesses often operate at a loss to prioritize rapid growth and expansion, startups can find themselves strapped for cash between major funding rounds. That's when bridge round financing typically comes in.

The term' bridge' symbolically represents its purpose - it provides startups a financial 'bridge' to cross the gap between their current funding status and the next planned financing round. It's typically seen as a short-term solution, providing enough capital to maintain operations and momentum while awaiting more substantial investment.

This type of funding usually comes in the form of convertible notes or a Simple Agreement for Future Equity (SAFE). Both these financial instruments allow startups to receive funds from investors without specifying a company valuation, a task often challenging for early-stage ventures.

Convertible notes are essentially loans converted into equity during the next round of funding, often at a discounted rate. On the other hand, SAFE is an agreement that gives the investor the right to purchase shares in a future equity round, again often subject to special terms or discounts.

Despite its short-term nature, bridge round financing often plays a pivotal role in a startup's financial journey. It can mean keeping the lights on during tough times or folding the business due to a lack of funds. Thus, understanding bridge round financing is vital for entrepreneurs and investors. But before we delve into bridge rounds, let's quickly go through startup financing in a general, broader context.

Understanding Startup Financing Rounds

Before focusing on bridge financings, let’s talk a little bit about startup financing rounds in general. It's important to understand the broader context of how startup funding works to fully recognize what the bridge rounds are.

Each stage of funding has its unique challenges and opportunities, and requires a good understanding of the milestones and growth expectations coming from angels and venture capital investors.

Let’s dive in and analyze each financing stage.

- Pre-seed is initial capital injection, often sourced from friends, family, or angel investors, is used to transform the startup's preliminary idea into a market-ready product or service. The amount raised during a pre-seed round is generally less than $1 million.

- Seed round - early-stage financial investment given to support a business until it can generate its own cash flow or until it is ready for further investments. It's typically the first significant round of financing after the pre-seed or initial self-funding stage.It's generally between $500,000 and $2 million.

- Series A - this is where startups are expected to present a strong business plan along with their prototype or market-ready product. Venture capitalists typically back this round, seeking to fuel business growth and market expansion. Series A rounds generally range from about $2 million to $15 million, but this can greatly vary based on the industry and the specific circumstances of the startup.

- Series B - financing for startups that have already demonstrated some level of success, and they're looking to scale their operations further. Series B rounds often range from $10 million to $50 million. Funding usually comes from venture capital firms, often with participation from the earlier round investors. The funds are typically used to scale the company, grow the customer base, expand into new markets, hire more staff, and further develop the product.

- Series C - by the time startups reach Series C, they are usually successful, established businesses looking for additional funding to develop new products, explore new markets, or even acquire other companies. The funding usually comes from late-stage VCs and private equity firms, and the amounts raised are often substantial, ranging from $50 million to over $100 million. The Series C round is typically focused on scaling the company rapidly and efficiently. This could be the last round of funding before an Initial Public Offering (IPO) or an acquisition.

- Series D and beyond - companies might seek a Series D for several reasons, such as preparing for an IPO, increasing the company's valuation before an IPO, or because the company needs a little more time and capital to achieve profitability or hit other key metrics before going public. Some companies may continue to take on more funding with Series E, F, and beyond, but these are less common and usually are unique to the specific circumstances of the business.

Despite these fairly distinctive stages typical for startup financing rounds, there can be gaps or financial shortfalls between them, and you guessed it - that’s where bridge financing comes in.

How Bridge Round Financing Works

Ok, so how exactly does bridge financing work?

Unlike traditional financing rounds that often involve equity sales at a preset valuation, bridge financing is structured through convertible notes or SAFEs, as mentioned earlier.

Let’s analyze the two scenarios:

- In a convertible note setup, the investment made is seen as a short-term loan that will later convert into equity during the next major financing round. This allows the startup to avoid setting a specific valuation at the time of the bridge round. Key elements of a convertible note include an interest rate, a maturity date, and often a discount rate or a valuation cap. The discount rate offers investors the benefit of converting their loan into equity at a lower price per share during the next round, while a valuation cap protects the investor's interest by limiting the conversion price, even if the startup's valuation skyrockets in the next round.

- On the other hand, a SAFE also avoids immediate valuation setting but does it in a more straightforward way, without the complexities of interest rates or maturity dates that come with convertible notes. Similar to a convertible note, a SAFE might also include a discount rate or a valuation cap to protect the investor's interest.

Additionally, it’s important to note that bridge round financing is essentially a reopening of an already issued class of shares. That means it’s less paperwork, less lawyer costs and no valuation.

When Is The Right Time To Raise A Bridge Round?

Bridge financings can happen at any stage during a startup’s lifecycle, however there are certain circumstances that usually direct founders towards raising a bridge round.

- Project Delays: If the product development or market launch timelines are extended beyond the initial estimates (which is not uncommon), a startup may face a financial gap. A bridge round can provide the resources to cover these overruns and keep the project moving forward.

- Milestone Achievement: A startup might be on the verge of hitting significant milestones that could greatly increase its valuation (e.g., achieving a key patent, launching a major product, securing a customer contract, or hitting a revenue goal). In such cases, a bridge round can provide the necessary funding to reach these milestones before conducting a larger round at a higher valuation.

- Tiding Over Adverse Conditions: During periods of economic downturn or sector-specific challenges, investors may be reluctant to invest, or the startup may be undervalued. In such instances, a bridge round can provide interim funding until conditions improve.

- Avoiding The Down Round Bullet: Raising money at a lower value (a down round) can be damaging to a company's brand, investor confidence, and staff morale. It can also lead to stock dilution. Raising a bridge round allows you to get additional capital without devaluing your company. This gives you breathing room to improve, raise the next equity round, and perhaps get a greater valuation. However, without a credible recovery plan and the conviction to execute it, the bridge round may merely delay the inevitable.

- Preemptive Measures: If a startup is performing well but anticipates that it may face a cash crunch in the future due to rapid expansion or high burn rate, raising a bridge round preemptively can provide a buffer and ensure continuity of operations.

- Opportunistic Moves: Startups sometimes come across unexpected growth opportunities such as a potential acquisition, a new market entry, or scaling up production to meet sudden demand surge. A bridge round can provide quick access to capital to leverage these opportunities.

- Extended Sales Cycle: For startups in sectors like B2B enterprise software or biotechnology, where sales cycles are long, a bridge round can help fund operations until revenues start to flow in.

Why Bridge Round Financing Can Be Essential For Startups

Navigating the startup landscape involves dealing with a multitude of challenges and uncertainties, which often includes unexpected financial pressures. Bridge Round Financing emerges as an essential survival tool during such circumstances. Here's a detailed look at why this form of funding becomes crucial for startups:

- Financial Buffer: Often, startups need a financial lifeline to stay afloat and meet immediate obligations like payroll, rent, and operational expenses. Bridge round financing provides this much-needed cash inflow, keeping the business alive and operational.

- Adverse Market Conditions: At times, external factors like economic downturns, changes in industry regulations, or a bearish investment market can make it challenging for startups to secure their next major funding round. In such situations, bridge round financing offers a lifeline, providing the necessary capital to navigate through the rough patch.

- Prolonged Development or Launch Phase: If a startup's product development or market launch phase gets unexpectedly extended, it can lead to delayed revenue generation. A bridge round can infuse the necessary funds to finalize the product and bring it to market, all while keeping the business running

- Strategic Delay of Equity Dilution: For startups anticipating a significant increase in valuation in the future, bridge round financing can be a strategic choice. By delaying a major equity round, they can secure better terms, thus giving away less equity in the long run.

- No Other Alternatives: Sometimes, startups may find themselves with limited options for raising funds, perhaps due to their current financial status or lack of investor interest. In such instances, a bridge round might be the only feasible option to secure the necessary funds and keep the business going.

However, it's important to remember that while bridge round financing can be a lifeline, it comes with its own set of risks. It could indicate to future investors that the company is struggling financially or has been overly optimistic about its growth prospects, potentially affecting future funding opportunities.

Pros and Cons of Bridge Round Financing

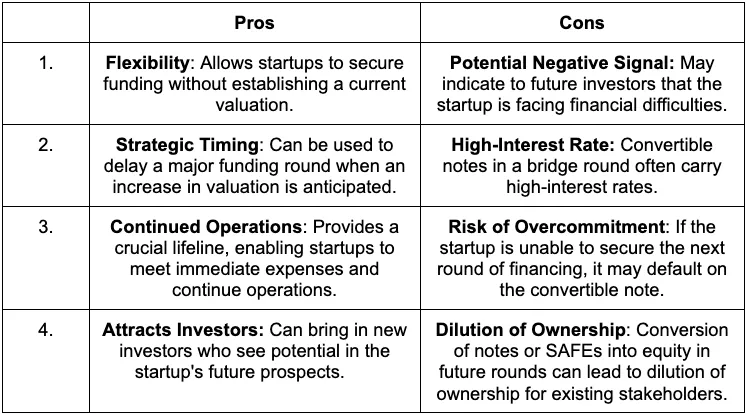

Bridge round financing, like any other form of financing, has its advantages and drawbacks. It's essential for startups to consider these before deciding whether to pursue this funding option. Below is a table summarizing the primary pros and cons of bridge round financing.

Conclusion

Bridge Round Financing serves as a critical strategic tool within a startup's financial arsenal, acting as a lifeline during challenging financial circumstances.

By offering a means to continue operations and maintain growth trajectories, it presents a valuable opportunity for startups.

However, the decision to secure a bridge round should not be taken lightly. It is imperative to weigh the pros and cons, understand the complex deal terms, and make informed decisions to ensure the best outcomes.

By doing so, startups can effectively utilize bridge financing as a stepping stone towards their next major milestone, creating a promising future for their venture.

by

by

by

by  by

by