Unless you have signed many contracts on behalf of a corporation, chances are you have no idea what a signature block is. A signature block on a contract is the text surrounding a signature which provides additional information about who is signing, when the contract was signed, and so on. Signature blocks typically include the name of the party (person or entity) entering into the contract, the names and titles of people signing on behalf of that party, and the contact information for that party.

Signature blocks are typically found at the bottom of most contracts. How signature blocks are set up and how parties sign the contracts can affect the validity and enforceability of the contracts.

Most people don’t pay much attention to signature blocks when a contract is signed. The most common issue that happens in contracts is when a signature does not match the signature block or the signature block is not set up correctly. In the worst case, the parties to a contract may have never fully-signed the contract and this will create issues if contract disputes arise in the future.

“Standard” contract provisions like signature blocks have become standard for a reason—because they serve an essential function in determining the validity of a contract.

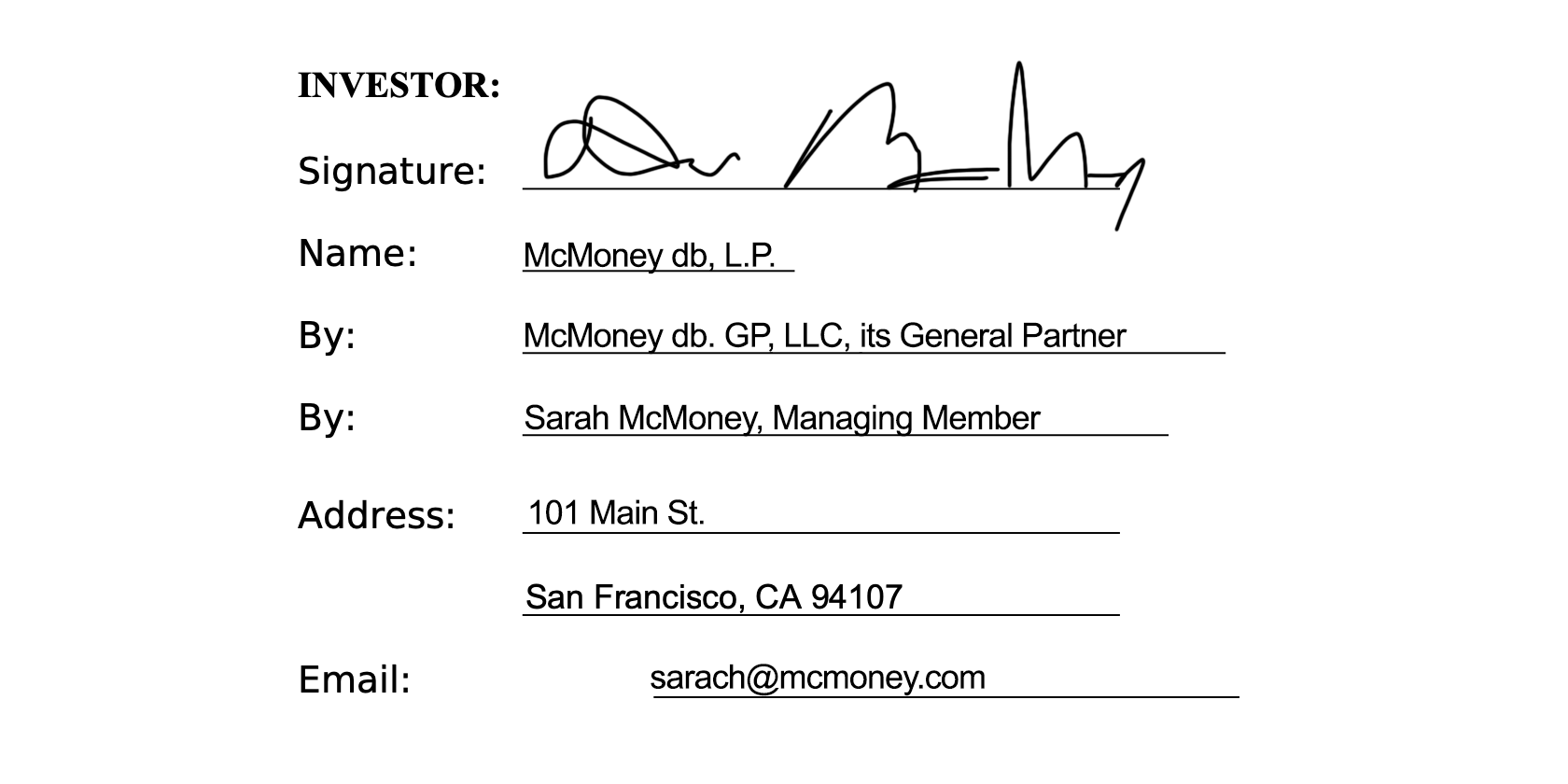

Typical Signature Block

A typical signature block to a contract will include:

- The name of the person signing the contract

- The name of the party on whose behalf the person is signing the contract, e.g. Prolific Corporation, Inc.

- The party’s entity type and state of formation, like “Delaware corporation”

- The capacity in which the person is signing, such as CEO or Designated Representative

- The role of the party’s in the contract, like “Investor” or “Shareholder”

- The date on which the contract was signed

- A line containing the actual signature of the person

The state where a company is incorporated and the type of legal entity (e.g., corporation or limited liability company) is important to clearly identify which entity is a party to the contract. Although legal entity names are unique within a state, the same company name could be in use in another state.

It is important that the individuals who sign contracts clarify that they are signing on behalf of a legal entity such as a corporation or LLC. Inside a signature block, this is denoted by including the word “By” before the signature and including the signer’s title underneath their signature.

If a corporate entity is the party entering into the contract, the individual signing should be sure that the corporate entity has given that person authority to sign the contract on its behalf. Most corporations appoint officers in the company by-laws and give them the express authority to sign contracts on behalf of the corporation. This is less common in limited liability company operating agreements

Avoid issues with invalid signature blocks in your contracts

Signature formalities for a legal agreement must be done properly to ensure the validity of the contract. Parties who overlook these contract formalities might end up facing unexpected problems or incur personal liability. Startups should have an experienced business attorney prepare or review their contracts before signing to avoid problems. Or use software like Capbase which automatically generates valid signature blocks for all equity and investor contracts your company enters into.

RELATED

Most Favored Nation (MFN) Clause in Startup Investing: What it is and how it works

Learn what the Most Favored Nation clause means in investing, how it is used in startup financing agreements, and why investors like it so much.

by

by

by

by