What are capital gains?

A capital gain is essentially the financial gain you make when you sell an asset for a higher price than you originally bought it for.

What counts as a capital asset? Virtually anything. The list isn't just limited to investments like stocks, bonds, or real estate. It could even be something you bought for personal enjoyment, like a piece of furniture or a boat.

Calculating the amount of your capital gain is as simple as subtracting the purchase price from the sale price. And here’s the fun part - the IRS can tax you on these capital gains in certain situations (which we’ll be covering in further detail in this article). Understanding capital gains and their taxation can help founders strategically decide when and how to sell your assets, potentially optimizing their profit after taxes.

In this article you’ll find information on:

- Differences between long-term and short-term capital gains

- What assets are taxed as capital gains

- Capital gains tax rates for 2023

- Qualified Small Business Stock Exemption (QSBS)

- Capital loss and its importance for capital gains tax

- Capital gains and alternative minimum tax

Key Takeaways

1. Understanding Capital Gains: Capital gains occur when you sell an asset for more than its purchase price. This includes not just investments like stocks, bonds, or real estate, but a wide range of items such as furniture or a boat. The gain is taxed based on whether it is classified as long-term (held for more than a year) or short-term (held for a year or less).

2. Different Tax Rates for Short-Term and Long-Term Capital Gains: Short-term capital gains are taxed at ordinary income tax rates, which can range from 10% to 37% based on your income. On the other hand, long-term capital gains enjoy lower tax rates of 0%, 15%, or 20%. This is designed to encourage long-term investment.

3. Capital Gains Tax Rates for 2023: For short-term gains in 2023, the tax rates can be as high as 37% for those in the highest income bracket. For long-term gains, the rates are lower, capped at 20% for those in the highest income category.

4. Special Provisions and Exceptions: There are exceptions to these rules, including the Qualified Small Business Stock (QSBS) exemption, which can exclude up to 100% of capital gains from federal tax if certain conditions are met. Also, some types of capital gains, like those from the sale of collectibles, can be taxed at higher rates. Additionally, capital losses can be used to offset capital gains and reduce tax liability. Finally, the Alternative Minimum Tax (AMT) can affect how certain incomes and deductions are treated, potentially leading to a higher tax bill.

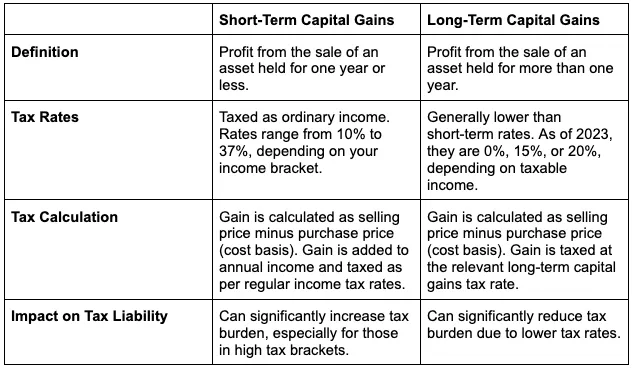

Long-term vs short-term capital gains

Long-term capital gains result from the sale of an asset that you've held for more than one year.

The tax rate on long-term capital gains is generally lower than the rate for short-term gains. As of 2023, the long-term capital gains tax rates are 0%, 15%, or 20%, depending on your taxable income.

Similar to short-term gains, the gain is calculated as the difference between the selling price and the purchase price of the asset. The resulting gain is then taxed at the relevant long-term capital gains tax rate.

The lower tax rate is designed to encourage long-term investment. Holding onto assets for longer periods can significantly reduce your tax burden compared to realizing short-term gains.

Short-term capital gains on the other hand arise when you sell an asset that you've held for one year or less.

Short-term capital gains are taxed as ordinary income. The tax rate can range from 10% to 37% depending on your income bracket as per the U.S. federal tax laws (as of 2023).

The gain is calculated as the difference between the selling price and the purchase price (cost basis) of the asset. The resulting gain is added to your income for the year and taxed accordingly.

Given that these are taxed at the same rate as your ordinary income, short-term capital gains can significantly increase your tax burden, particularly if you're already in a high tax bracket.

What assets are taxed as capital gains?

- Real Estate: This includes homes, land, and other properties. However, the sale of a primary residence often qualifies for capital gains exclusion if certain conditions are met.

- Stocks and Bonds: These are commonly traded assets, and the profit made from selling these investments are subject to capital gains tax.

- Collectibles: Items such as art, coins, antiques, and other collectibles are subject to capital gains tax. However, they are often taxed at a higher rate than other capital assets.

- Business Interest: This can include ownership shares in a business. When sold, the gain realized is subject to capital gains tax.

- Personal Property: This includes items like cars, boats, and other personal property. Capital gains tax applies if you sell the item for more than you paid for it.

- Investment Property: This includes rental properties and second homes.

- Mutual funds: Capital gains taxes apply to profits from the sale of mutual fund shares.

Capital gains tax rates for 2023

Capital gains, or the profit you make from selling assets, become taxable in the year when you make those gains, i.e., when you sell. So if you sold your startup shares in 2023, you'll need to account for capital gains tax when you file your tax return in 2024.

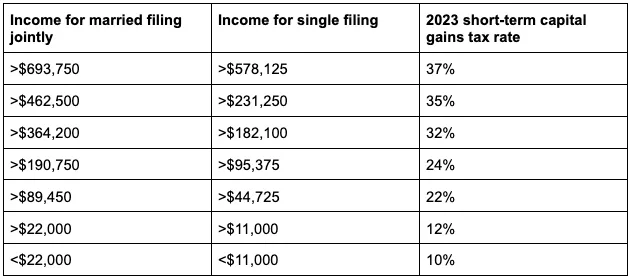

Short-Term Capital Gains Tax Rate for 2023

Short-term capital gains are taxed at your normal income tax rate. This rate varies between 10% and 37%, based on your income and filing status.

Here are the 2023 marginal tax rates for reference:

Source: IRS

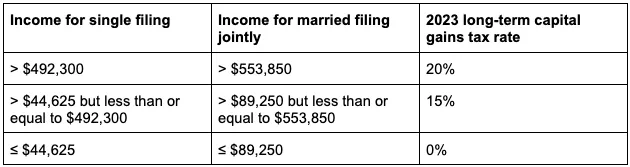

Long-Term Capital Gains Tax Rate for 2023

Long-term capital gains, from assets held for more than a year, enjoy a lower tax rate - 0%, 15%, or 20% - based on your tax bracket and filing status.

Here are the tax brackets for long-term capital gains:

Source: IRS

Let's consider an example: a startup founder who is single and earns $200,000 in capital gains in 2023. According to the tax brackets for 2023, he’d pay 32% tax on any short-term capital gains but only 15% tax on any long-term capital gains.

It's also important to note that there are exceptions. Some types of long-term capital gains, like those from the sale of collectibles and certain small business stocks, could be taxed at rates higher than 20%, sometimes up to 28%.

Qualified Small Business Stock Exemption (QSBS)

Qualified Small Business Stock (QSBS): Under Section 1202 of the Internal Revenue Code, founders and other owners of Qualified Small Business Stock can exclude up to 100% of their capital gains from federal tax if they meet certain requirements:

- Stock must be in a C Corporation (not an LLC or S Corporation),

- Company's gross assets must $50 million or less at the time of stock issuance

- Stock must be held for at least five years

The 5-year holding time for QSBS is, in general, the most crucial criteria to satisfy. The 100% capital gains exemption will not apply if you sell your stock too soon. Even if you must sell your QSBS stock before the expiration date, you can avoid paying capital gains if you reinvest your earnings within 60 days of the sale in new QSBS.

What is a capital loss?

Capital loss is the polar opposite of capital gain. When you sell an asset for less than what you paid for it, you’ve effectively taken a capital loss.

Taxpayers can use both short-term capital losses and long-term capital losses to reduce capital gains tax from the sale of their other assets. Maximum net loss you can claim in one year is $3,000, with the excess carrying into the next year.

What is the alternative minimum tax (AMT)?

The alternative minimum tax (AMT) is a tax system in the United States that runs parallel to the standard income tax system. It's designed to ensure that high-income individuals, corporations, estates, and trusts pay a minimum amount of tax, especially those who might otherwise avoid significant taxation through deductions and credits.

Here's where the connection to capital gains comes in: For the purposes of the AMT, certain types of income and deductions are treated differently than for regular tax purposes. The differences in how the income and deductions are calculated can result in a higher taxable income base for AMT than for regular tax, which could lead to a higher tax bill.

In terms of stock options, specifically Incentive Stock Options (ISOs), the connection to the AMT is crucial.

When an individual exercises an ISO, the "bargain element" (the difference between the exercise price and the market value of the stock) is not considered taxable income for regular income tax purposes, but it is for AMT purposes. This means that exercising a significant number of ISOs could potentially trigger the AMT, resulting in a higher tax bill in that year.

by

by

by

by