How To Properly Deal With a Co-Founder Leaving Your Startup

by Stefan Nagey • 4 min readpublished March 28, 2021 • updated December 4, 2023

by Stefan Nagey • 4 min readpublished March 28, 2021 • updated December 4, 2023

Choosing the right co-founder is one of the most important decisions you will make as a startup founder. Think of the relationship between co-founders as more than just that between business partners. You will want to cultivate a long-term, close working relationship with your founding team. However, just like any other relationship, your business partnership with your co-founders may not work out in the end.

The departure of one of the founders can have a huge impact on a startup, particularly when you are raising funds from investors. You will want to make sure to take the appropriate legal steps when parting ways with one of your startup’s co-founders.

In this article you’ll find information on:

- What steps you can take to avoid a messy break up with your co-founder

- What are the reasons why your co-founder might want to leave your company

- How to handle your co-founders departure

- What happens after a co-founder leaves a startup

How to Avoid Messy Co-Founder Exits

There are several steps that you can take when first starting your company to make the departure of a co-founder easier to deal with down the road.

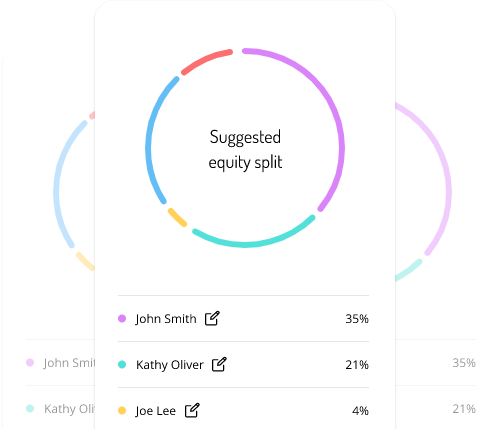

One critical way to protect you and your company should one of the founders leave a startup is to always have vesting provisions on founder shares. If your co-founder leaves before their shares are fully vested, the company will be able to take ownership of the unvested shares, avoiding the situation where there is “dead equity” on the startup’s cap table. This term denotes when there are shareholders in the corporation who hold a sizable amount of shares and no longer contribute to the development of the company. Vesting schedules for founder shares can mitigate the risks of any future ownership disputes if one of the founders leaves the company. Capbase makes it easy to setup and customize vesting schedules when issuing equity to co-founders and company employees.

One famous real-world example where founder equity was not handled properly is Zipcar. Many years before Zipcar became a successful business, the founders entered into an agreement with a 50/50 equity split in the company. When the relationship between the founders went sour, one of the co-founders, Antje Danielsen, was forced out. However, because her stock was not subject to vesting, she retained half the shares in the company even though she was no longer involved in any way!

Another way that startups can protect themselves in the event of the departure of one of the founders is by having each of the founders sign a confidential information and invention assignment agreement with the company prior to beginning work on the startup. This agreement protects the company’s confidential information and assigns the ownership of the inventions and work product of the founders to the company. By signing these agreements, you can potentially avoid a situation in which your co-founder leaves, claims possession of the startup’s intellectual property, and builds a competing company.

Why Your Co-Founder Might Leave Your Startup

A co-founder leaving a startup is certainly not an uncommon event in the startup world and there are several reasons why someone might choose to leave their own company. In some cases, a co-founder may leave to pursue other professional goals, like a full-time role at another company. Depending on their personal and financial circumstances, they may also choose to leave because they cannot endure the financial hardship (most startup founders don’t pay themselves much salary when first getting started) or personal stress of building a startup.

In most cases, co-founders leave a company because the founding team no longer agree on the startup’s direction or have fundamental disagreements about how the company should be run. In this scenario, if you are unable to come to a resolution and your co-founder does not agree to leave amicably, you and your board may decide that the appropriate resolution is to terminate the co-founder to avoid future problems.

The right way to handle the departure of a co-founder

Once you know that your co-founder will be leaving the startup, it is imperative to communicate this information to your team, outside investors and board members. While a co-founder exit can create a lot of turmoil inside of a startup, letting your investors know exactly what is happening will build trust and confidence in your relationship. They can also help you in your attempts to recruit senior management to join the company to fill the void after a co-founder leaves.

If your co-founder is not a member of your startup’s board of directors, you can fire them at any time. However, if your co-founder is a board member, then terminating them is much more complicated. First, your board will need to vote on your co-founder’s termination. Even if the board votes to terminate your co-founder, your co-founder may not agree to leave willingly and could come back with demands that they want me before agreeing to depart from the company. The last thing you want to happen is a messy exit with lawsuits, so it is important to always work with an attorney when faced with this situation in order to avoid future legal disputes.

The other thorny issue to address is how to deal with your co-founder’s equity. If your cofounder was issued shares that have already vested, they own this equity and there’s not much you can do to claw it back. If they have options, they can opt to exercise any options that have already vested as well. Even if you had a vesting schedule on your co-founder’s share grant and some shares were unvested, you will need to make sure to reclaim the unvested shares in accordance with the repurchase agreement attached to the founder share grant. Typically, you will have to pay the original price per share at which the co-founder purchased the stock for any unvested shares that are being reclaimed, in addition to notifying your co-founder that the company is exercising its right to repurchase the shares.

What happens after your co-founder leaves your startup

Once you know your co-founder is leaving your startup, you will want to come up with a plan to deal with the interim period where you and your team will need to take over your co-founder’s former work responsibilities. Your team may be alarmed that a key member of the leadership team has left. In these situations, it is best to be forthcoming and transparent about why your co-founder left and to have a frank discussion about your vision for the future of the startup.

A co-founder leaving can be a huge loss for any company, but it does not have to spell the end of the startup’s journey. As long as the relationship is terminated in a fair, legal and transparent fashion, your startup can avoid legal issues and potentially bounce back from the loss of one of the members of the founding team.

Summary

- To avoid disputes over ownership in case a co-founder leaves the company, startups should have vesting provisions in place for all founder equity grants

- There are many reasons a co-founder may choose to leave a company

- In most cases, the co-founder relationship is not working out and one of the founders is being terminated

- It is simple to fire a co-founder who is not a board member

- It is much more complicated to fire a co-founder who sits on the startup’s board of directors

Written by Stefan Nagey

Serial entrepreneur, engineering & business leader who co-founded and led his last startup to a $14M Series A financing and a successful exit. Years of experience leading teams & building scaleable, secure software systems.

Related

How to find a co-founder: Practical advice from experienced founders

Learn how experienced startup entrepreneurs choose their co-founders and what traits you should look for when picking yours.

by Michał Kowalewski • 4 min read

by Michał Kowalewski • 4 min readVesting Schedules: Best Practices for Startup Founders

Vesting schedules play an important part in keeping a startup together. They’re a designed as a motivator not only for employees, but also for founders. If you have them, it sends a signal to investors, that you’re in it for the long haul.

by Greg Miaskiewicz • 7 min read

by Greg Miaskiewicz • 7 min read5 Cap Table Mistakes to Avoid

Make sure you avoid the most common mistakes founders make when setting up their cap tables. Some of these issues can create major problem later on, including turning off potential investors.

by Capbase Staff • 7 min read

by Capbase Staff • 7 min read