How to Get an Investor’s Attention: 6 Unwritten Rules for Cold Emails

by James Hottensen • 7 min readpublished January 27, 2021 • updated December 4, 2023

by James Hottensen • 7 min readpublished January 27, 2021 • updated December 4, 2023

How to Get an Investor’s Attention?

Getting an investor’s attention is a more mechanical process than many people often think. Having a strong network helps a lot, but if you don’t have a strong network, you can benefit from adhering to a few unwritten rules. The most important thing is to not seem ‘random’ and/or ‘spammy’.

For some background, I was an Associate/Principal at Great Oaks Venture Capital for 5 years before joining Capbase full time. I have seen hundreds, if not thousands, of cold emails and referrals.

It’s very tempting to want to write a thorough explanation of your product and pour your heart and soul into your cold outreach. But I will speak from experience: brevity is your friend. Overall, your goal is to de-risk yourself to the investor. If you are speaking with a junior person at a firm, you have to remember that he/she is safeguarding their own reputation internally: they want to show their committee that you are sophisticated and in turn, that they are sophisticated by showing your product to the rest of team.

In other words, when you email one person at a firm, you are emailing everyone. So it’s essential that you nail this email and adhere to the ‘unwritten rules’.

The 6 Unwritten Rules for Cold Emails

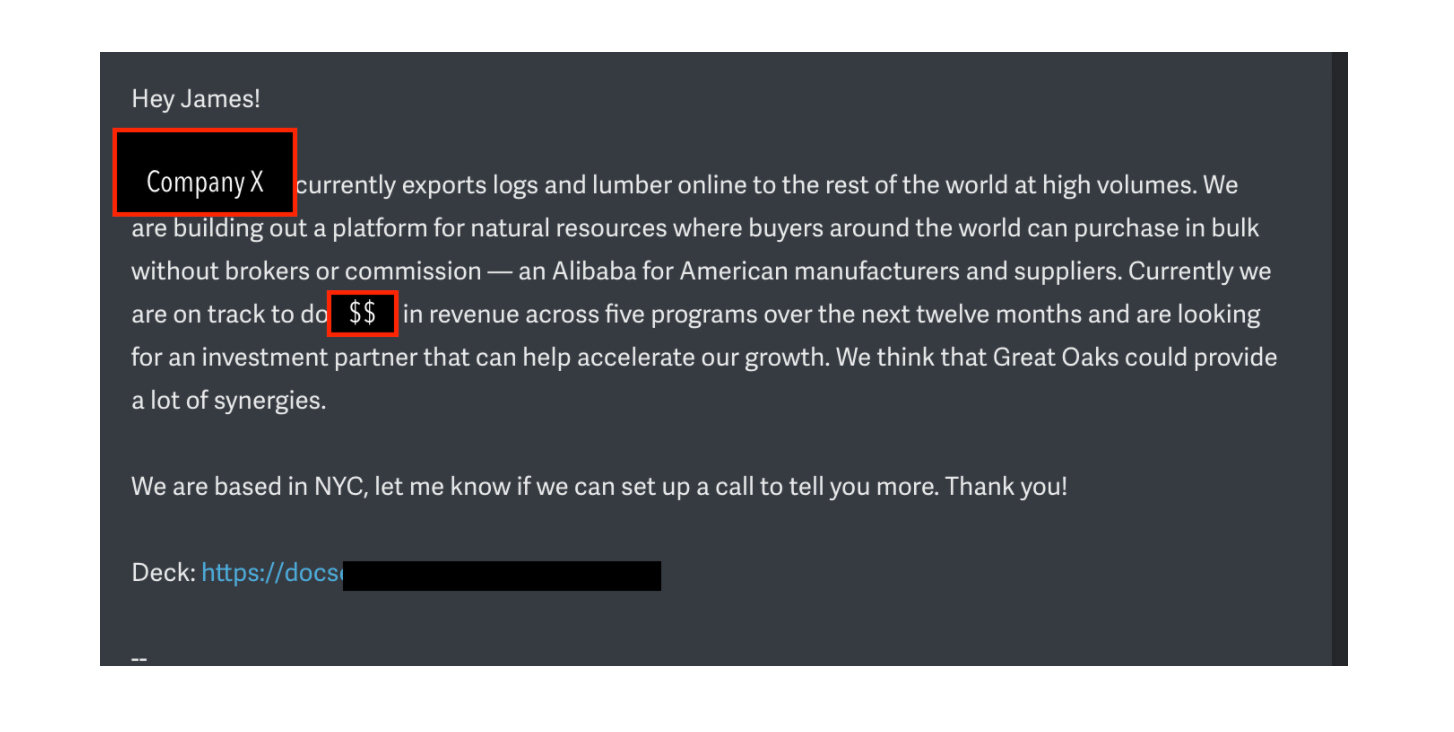

1. Don’t spam/use blast emails: make sure every email is tailored to the VC you are speaking to. It’s very easy to tell when an email isn’t personalized, and it makes you look desperate.

2. Make your cold email as short as possible. The first 2 sentences of the email should explain why the specific firm you are talking to would be a good fit. Your idea really should be explained in 1 sentence. If you extend this to 2 sentences, you are in danger of losing the reader.

3. Be delicate about how you update your process so far. Despite the conception of VC’s being ultra-rational and sophisticated investors, very few actually like to stick their necks out and take risks without social validation. This is an unfortunate truth, and it creates a chicken and the egg problem for many entrepreneurs. The most important thing to signal to VC’s is that other people have invested in you, and they would not be investing alone.

4. Do not disclose valuation in opening email. This is a rookie mistake that many entrepreneurs make. Your valuation at the early stage is negotiable so do not commit to a number. Some may say that you can hint at a valuation ‘range’, but I think that’s only applicable if you have found a lead investor and you need a few more checks to close out a round.

5. Never ask someone to sign an NDA. This is becoming less common but still occurs sometimes. It may seem like the prudent thing to do as you are protecting your IP, but no VC has the bandwidth to actually use the information in your deck against you. And even if you do send the NDA, the VC won’t sign it. Finally, making an investor sign an NDA gives the impression that you do not trust the investor, and that’s not a great place to start a relationship.

6. Send a deck. If you are sending to an associate or junior employee at the VC fund, it’s even more important to give them something to read. If you don’t send a deck, you are just prolonging the inevitable: either the associate/principal will ask you for it, or their boss will ask them for it. Many entrepreneurs create a ‘teaser’ deck that is lighter on the details than a full investment deck that they send to investors with whom they have a more fortified relationship. That is a viable option if you don’t want to disclose too much information early on.

How to phrase your fundraising process?

If your startup hasn’t raised any money:

“We are just kicking off our fundraising process and are speaking to early-stage investors in the [city] area…”

If your startup has raised some money

“We have [amount] committed, and we are looking for additional investors. We have a soft timeline of [date] to close the round….]”

*Do not post a specific closing date. Say “January 2021” not, “January 8th, 2021”. Closing always takes longer than you think, and by boxing yourself into a specific date makes you look unsophisticated.

If your startup is looking for one last investor in the round:

“We have [amount] left in the round, and we would love to have you fill it out. We would like to close in the next 2 weeks, so if there is interest, please let us know.”

Overall, it's important to signal confidence in your ability to attract capital and that you don't need this particular investor's money. You have options.

So how does a really good cold email look like?

Here's an example:

Conclusion

Raising money is a relationship play, not a lottery play. Treat each first contact like the beginning of a relationship. Most investors are publicly reachable, with websites that spell out their theses and contact processes.

RELATED

Pre-Incorporation Checklist: 6 Steps Before Startup Incorporation

We cover the important steps founders should take before incorporating their startup: choosing business entity, state of incorporation, name & more.

Written by James Hottensen

James joined Capbase after working at Great Oaks Venture Capital in New York where he worked on various fin-tech and consumer investments as an Associate, including Capbase and Golden. He previously worked at Tentrr, a Series A startup in New York, leading Strategy and Partnerships.

Related

C Corporation or LLC: Which is the best entity for your startup?

Startup investors strongly prefer to invest in C Corporations over LLCs for tax and diligence reasons. The proceeds from selling stock in startups registered as C Corporations can be tax exempt due to Qualified Small Business Stock exemption.

by Capbase Staff • 5 min read

by Capbase Staff • 5 min readHow to Register A Company in the US: Everything You Need to Know as an Overseas Founder

Registering in the US opens the door to venture funding for overseas startups. Learn about the process for registering your company in the US as a foreign citizen, including incorporation, taxes, visas and more.

by Greg Miaskiewicz • 9 min read

by Greg Miaskiewicz • 9 min readHow Many Shares Should a Startup Authorize

When you are incorporating your startup, you need to decide how many shares to authorize. Most startups authorize 10 million common shares when first setting up their corporation.

by Capbase Staff • 7 min read

by Capbase Staff • 7 min read