Co-founder disputes are the number one killer of new companies—Harvard research indicates they’re responsible for as many as 65% of all startup failures. Disagreements over the division of startup equity can turn into a wedge that drives co-founders apart at record speed, generating hurt feelings at best and dissolution of the company at worst.

Despite this, according to a survey of over 6,000 startups by Harvard Business Professor Noam Wasserman, in about 40% of them, entrepreneurs spent less than a day considering the equity split between members of the founding team.

Is Equal the Same as Equitable?

At such an early stage in the relationship between co-founders—particularly first-time founders—it’s not hard to see why they’d gloss over such an emotional and financially impactful issue. Given a typical startup equity structure, to say “Let’s split 50/50” or “Let’s split 25/25/25 and get on with it” provides a simple resolution to the problem—and the appearance of fairness in the allotment of founder shares.

However, it’s rare that founders split the work that makes a company work equally—and VCs know this: the same Harvard study found that companies with equal equity splits had more trouble getting funding than their counterparts. Having no “deciding” vote can also cause a logjam between the founders in some cases.

Methods to the Madness

Like everything else at the early stages, dividing equity shares equitably comes down to doing your homework. This isn’t always as simple as it appears. Despite inevitable complaints to the contrary, the founder behind your company's "original idea" isn’t necessarily as important as the technical founder that makes it happen, and the most experienced founder won’t always deliver the most value.

Numerous rubrics, calculators and matrices have been devoted to determining this split—and ensuring its fairness—but most companies find it comes down to a consideration of the capabilities, availability, and value generated by each of the startup founders. Possible questions to be asked at this stage could include:

- Are they committed on a part time or full-time basis?

- Are they technical or sales-based?

- Do they hold the keys to funding the company?

- Are they established as players in the market?

- Will they be the primary force driving the company’s success?

- Are they investing their own money?

- Are they contributing intellectual property to the company?

Good equity allocation decisions will take time, and likely start with clear conversations about the duties and expectations of each founder, which tend to evolve as the business does. Equity numbers are not set in stone, so as responsibilities change, your equity picture may change too.

It may be helpful to think of your business plan—particularly, your plans for the next four years: If everyone performs as expected, how much of the company’s success will they be responsible for? After careful consideration, you may even find that the appropriate distribution for your company is a 50/50 split! In cases like this many companies may split 51/49 in order to avoid gridlock.

The important part is that the decision you reach should be a well-considered one.

Dynamic Split

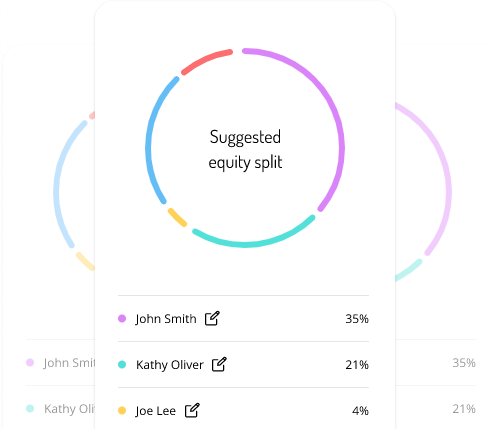

Dynamic split is a way to assign equity based on what founders actually contribute with.

The idea is to calculate the value of individual contributions like time relative to other members of the team.

There are a number of variables like cash, important relationships with potential customers and investors, or time.

They all have a relative value, for example, a senior Twitter engineer’s time would be worth more than that of a recent college graduate.

The dynamic model attributes a relative value to these various contributions from each team member.

This fair way of splitting equity ownership determines the appropriate percentages by dividing the contributions of one individual by the contributions of all the members of the team. This provides an exact calculation of ownership based on a person’s actual influence on the company.

A dynamic model will change over time as new contributions are made, unlike a fixed-split one.

Since all values are relative, the dynamic split model is guaranteed to be fair for all participants, it rewards equity stakes on the level of contribution.

Founder stock should be subject to a vesting schedule. As the article How Vesting Schedules Work—and What They Mean to Founders deals with in depth, an accurate vesting schedule prevents a founder from walking with a full equity grant after the first year in business. When their shares have a vesting schedule, if a founder leaves the company early, they could suffer a considerable loss.

It’s also your best insurance against a failed partnership destroying your company as it provides a mechanism to buy back any unvested shares from departing founders in order to re-allocate them. In the interest of fairness, the vesting schedule is often the same for all founders, if not all employees, but not always. We have provided support for both scenarios in the equity management portion of Capbase.

Inking the Documents

When all the negotiations are done, the terms of co-founder equity are generally rolled into the Articles of Incorporation (sometimes called the “Charter”) and the Stock Vesting Agreement.

In the documents provided by Capbase, these agreements will specify not only the amount of equity received by each founder and the vesting schedule, but can include other clauses like Rights of First Refusal, which allows founders to buy back equity from departing founders. Our built in equity calculator guarantees these decisions are reflected in your cap table.

Remember that you’ll likely want to take a look at Don't Wait to File Your 83b Election to ensure that you get taxed on the strike price of your company stocks while they are low!

Free-Riders & Good Reason

Like having a partner who doesn’t pull their weight in any form of entrepreneurship, a so-called “free-riding” founder or co-founder can hamper your progress and generate bad will. A new startup is an extremely volatile entity, and it’s in your best interest to deal with any issues like this in the near term rather than later on.

Since all vested shares include voting rights at the founder level, it is especially important to shed dead weight as soon as possible to avoid such issues from derailing your company.

This is precisely the reason most Founder Share Purchase Agreements include terms for a pre-authorized buyback of unvested shares. These provisions allow the company to re-purchase the unvested common stock options of an employee who is fired or leaves the company so they can now be able to allocate it to a new employee, founder, advisor, or wherever it is needed.

The Founder Share Purchase Agreements and other employee equity purchase agreements are available as default documents in Capbase, along with line items spelling out the vesting schedule, terms, and other clauses and line items concerning other things like accelerations.

Sometimes employees leave for what’s called a good reason. Good reason is legalese for any combination of changing job roles, changing company needs, and/or relocation issues, and a few other no-fault issues. If an employee is fired or quits for good reason, they may also trigger an acceleration leading to the partial or full vesting of their options.

Fixing the Split

I hope by now we’ve convinced you to carefully consider how you divide your equity! In the case that your percentages of equity compensation become a problem, you do have a few methods at your disposal to remedy the situation with a minimum of disruption, including mediation. Having a strong and complete Partnership Agreement will take you a long way toward ensuring that these consume as little of your crucial growth time as possible.

How do succsessful founders split their equity?

To give you a practical perspective on how founders actually approach the topic of splitting equity and roles in a company, we talked to Joao Batalha, co-founder and CEO of Amplemarket. Joao shares his experience regarding distributing roles, responsibilities, and equity compensation at the early stages of startup development.

Summary:

- Disputes over equity can kill an early stage startup fast.

- The founder equity split should be a considered, not hasty, decision.

- Studies show VCs prefer uneven splits, but startups still often split 50/50.

- Equity splits may be renegotiated down the line, especially at large stage funding events.

- Dynamic split is a fair way to assert equity based on each individual's contribution relative to the team.

- The initial stock grant to founders defines how much stock is awarded.

- Founder exits may be accompanied with accelerations of stock vesting.

RELATED

Pre-Incorporation Checklist: 6 Steps Before Startup Incorporation

We cover the important steps founders should take before incorporating their startup: choosing business entity, state of incorporation, name & more.

by

by

by

by