The Ultimate Guide to Cap Tables for Startup Founders

by Greg Miaskiewicz • 8 min readpublished April 5, 2021 • updated December 4, 2023

by Greg Miaskiewicz • 8 min readpublished April 5, 2021 • updated December 4, 2023

Many first-time founders have little clue about how capitalization tables work when they are launching a new startup. They also have little time to focus on learning the financial and legal side of the business. Founders should be focused on building great technology and understanding their target market, not on legal compliance or tracking their stock ledger.

To help founders navigate the complexities of starting a company, we put together a primer for founders to understand how their startup’s capitalization table (or cap table) will evolve through the early stages of building their companies, from incorporation to raising priced financing rounds.

Think of your cap table as a complete record of your company’s ownership structure, including any convertible debt on the balance sheet and liquidation preferences held by investors.

What is a cap table?

A capitalization table (known as a "cap table") is a document in the form of a spreadsheet or a table that lists the owners of a firm. It contains a complete list of the company's shares or securities, including stock, convertible notes, warrants, and equity grants.

A basic capitalization table identifies the various types of equity ownership capital, individual investors, and share prices. A more complicated table may include information on potential new funding sources, mergers & acquisitions, public offerings, or other speculative transactions.

Startups often use cap tables privately to provide information on a company's investors and market value.

Before you incorporate your company

The initial stage of a startup is when the founders are exploring an idea and maybe begin building something… but haven’t yet made it official by incorporating their startup.

Founders often begin with a casual, informal and often verbal arrangement as to how they plan on splitting the equity in the company with their co-founders. When working with co-founders, it’s important to incorporate the company sooner rather than later to avoid messy disputes about ownership of the startup’s intellectual property and stock. Learn about how to decide on how to split equity among co-founders.

Before you begin work on your startup, make sure to iron out specific details about your working relationship with your co-founders, such as:

- How will you split equity, e.g. 50/50 split or some other arrangement

- Determine the vesting schedule for the founder equity. A 48 month vesting schedule is the norm in startups, as well as a 12 month cliff before any shares are vested. If one founder started working on the project earlier than the other founders, it is reasonable for their vesting schedule to reflect this or to have a percentage of their equity granted up front, not subject to vesting.

- If you or any of your co-founders are investing their personal funds into the startup, discuss how this will impact the stock ownership of each of the founders, as well as the terms of the investment. When investing personal funds into your own startup, it is important to do this cleanly and maintain proper documentation.

- Intellectual property concerns, like if one of the founders is transferring ownership of a patent or invention to the company in exchange for equity in the company

It is important to have these conversations early on, even if the conversation is uncomfortable, since this will avoid fundamental disagreements between the founders later on. Most startups fail due to co-founder disputes, not because of inability to raise funds or running out of money.

At company formation

When you incorporate a company, you must select how many shares to authorize in your new corporate entity in addition to granting equity to the founding team. Most startups incorporate in Delaware as C Corporations. Most VCs will not invest in LLCs for diligence and tax reasons.

When you first incorporate your startup, your cap table will typically include:

- Date the company was incorporated in Delaware

- Amount of shares authorized; at this stage, typically, companies only have common shares when incorporating. Most startups authorize 10 million of more shares when they get file to create a new corporation. The number of authorized shares is listed on the articles of incorporation filed and approved by the Delaware Division of Corporations.

- Stock issued to each founder, along with the vesting schedule and vesting commencement date

- 83(b) elections filed with the IRS; founders typically file an 83(b) election when first purchasing their shares to get preferential tax treatment if they sell their equity in the future

- Stock plan assigning equity to an employee stock option pool. Typically, at the time of incorporation, companies will set aside 10-20% of the company’s shares to be used as part of equity compensation packages for key employees. Authorizing these shares for future issuance to employees does not affect the founder’s ownership percentage in the company until these shares are both issued to employees and then vest.

When you raise your first funds from investors, they will typically ask for a pro forma cap table summarizing the above information, as well as any outstanding debt or warrants.

Keep in mind that the cap table is not a legal document — your cap table summarizes the equity you have issued in your company, but each of these share grants are recorded in separate contracts and must be approved by the company’s board of directors. The company’s document room will contain all the legal agreements that the startup has entered into, including 83(b) election forms, stock purchase agreements, stock option agreements, stock option exercise agreements, and so on.

Hiring your first advisors, consultants and employees

Stock and stock options are a key part of startup recruiting efforts. Most early stage startups cannot afford to pay competitive, market-rate salaries, but they make up for this by offering generous equity grants to incentivize employees.

When a startup first starts out, the company typically issues restricted shares to advisors, consultants and employees. At Capbase, when we first started out in 2018, we compensated consultants for working on our web application with generous grants of restricted shares in the company — pure sweat equity, no salary. Months later, after we raised some funds from investors, we hired our first full-time employees.

After a startup raises a priced round from outside investors, the company must get a 409A valuation from an outside appraisal firm to put a price on the company’s common shares. This is also when startups switch from granting restricted shares to employees to stock options. Learn about the difference between shares and stock options.

When issuing shares to employees, the startup must always issue shares at the fair market value of the company common stock — issuing shares at too low of a price can result in legal penalties and tax issues for both the company and its employees.

Employees will typically have more upside and preferential tax treatment from restricted stock than they would from stock option grants. To be employee friendly, typically startups will issue restricted stock for as long as possible. Only after raising a priced round and issuing equity to investors will the company switch to issuing stock options as part of employee compensation packages.

Keep in mind that, when issuing restricted shares, you must take the proper steps to reclaim the unvested shares when the employee leaves the company. Otherwise, the employee will default to receiving their full share grant, including any unvested stock.

One other compliance piece that is important to do correctly when granting restricted shares — just like your founder share grant, you will need to get a copy of the employee’s filed 83(b) election for the company records. This typically applies only to US taxpayers and US citizens, and not to any overseas employees who do not have (and do not plan to have) tax residency in the United States.

Raising funds from angel investors & pre-seed funds using SAFEs or convertible notes

This is the stage at which founders will typically start to pay attention to their cap table in large part because potential investors will ask to see a pro forma cap table before investing. Here’s what an investor is looking out for when they ask to see your startup’s cap table:

- Who owns the equity in the company; this is important to determine whether the team incentivized to see the project through

- The biggest red flag at this stage is dead equity, for example, when a co-founder who has departed the company but retains 40% of the common shares, an advisor with an above market share award of 10%, or an investor that owns 40% of the company for investing a small sum at a low valuation

- How much of the employee stock pool has already been issued to employees and what percentage is left to incentivize future key hires

- What other notes, warrants, SAFEs are in place and how they will convert in a future priced financing round

When you sign a convertible note with an investor, it is important to record the note’s terms on the company’s cap table, such as the maturity date, interest rate, discount and valuation cap. A SAFE or Standard Agreement for Future Equity is similar to a convertible note in that it will convert in the next priced round and includes terms like discount and valuation cap. However, SAFEs are not debt instruments and function much like warrants, so there is no maturity date or interest rate. Learn about the key differences between SAFEs and convertible notes.

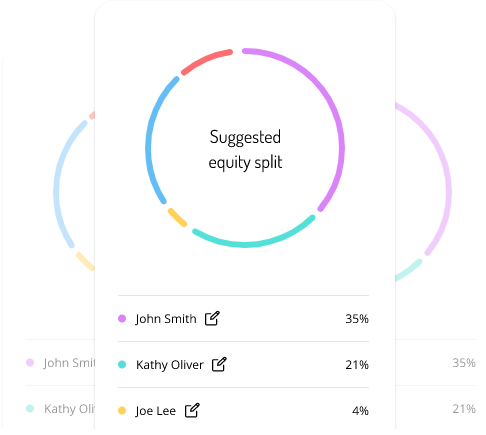

Capbase makes it easy to understand how convertible notes or SAFEs will convert in future financing rounds, before you sign investment agreements with investors. Many founders sign a bunch of SAFEs without understanding what percentage of their company they are selling to investors, only to discover that the SAFE holders will own 10-15% of the company after converting in the next priced financing round.

Your first priced round: Priced Series Seed or Series A

Once you decided to raise additional capital to fund your startup’s growth, it is important to think about how much money you need and how much of your company you are willing to sell to investors in exchange for the capital investment.

Understanding your cap table will help you understand how additional fundraising will affect your ownership stake in the company. When you raise your first priced round, any convertible securities such as SAFEs or convertible notes will convert into preferred shares, so you will want to understand these conversion dynamics before deciding on what percentage of the company you are willing to give up in your Series A.

When negotiating with new investors about the valuation and ownership terms in your first big financing round, you will want to make sure to have an accurate cap table. Failure to have this information readily available or sending over a cap table with glaring inaccuracies will be seen as a red flag by potential investors. While some errors can be corrected by your legal counsel during the due diligence process, it is best to make sure to maintain accurate financial and legal records for your startup so that you can breeze through due diligence. Cap table errors can delay the closing of your financing round, or, in the worst cases, cause the investors to call things off.

Besides diligence, it helps to have an accurate cap table prior to beginning the financing process, so that you can model out the financing round in advance before agreeing to terms. It is hard to understand the dynamics of the funding round and how they will dilute your equity holdings as a founder… unless you have accurate data about who owns shares in your company. Learn more about how pre-money valuations and post-money valuations work in priced financing rounds.

Often, when negotiating the first equity round with investors, founders may be asked to further dilute their ownership stake in their startup through what is known as the “option pool shuffle”. If investors deem your current employee stock option pool to be insufficient in size, they can ask for more options to be authorized to incentivize future key hires, which is a source of dilution. This dilutes only existing common shareholders, and not any of the investors that own preferred stock in the company. Here is a good post on the option pool shuffle.

How Capbase helps founders maintain a 100% accurate cap table in real-time

Unlike other software you could use for managing your cap table, Capbase automatically updates your cap table as you raise funds from investors or issue equity to founders, employees and advisors. Because our software generates the contracts and handles e-signatures, we can automatically update the company’s cap table and document room after equity agreements are signed. Unlike other cap table management tools, your capitalization table on Capbase is always up to date!

Summary

- To avoid encountering issues raising money in the future or spending huge sums of money on legal bills, it is important to get your cap table right from the beginning and to keep accurate records as you issue equity to employees or raise money from investors

- Your cap table is not a legal agreement, but it is a summary of the equity ownership of all stakeholders in your company, including founders, advisors, employees and investors, as well as the number of shares (both outstanding shares and issued shares)

- An accurate cap table helps you understand dilution of your ownership stake as you raise funds and issue equity to employees

- The total number of shares authorized by your company will change as you issue preferred shares to investors or increase the size of your employee stock option pool

- When issuing equity to employees or raising funds from venture capitalists or angel investors, you should always keep your cap table up to date. Capbase makes it easy by keeping your cap table updated in real-time

- Failure to keep accurate records or issuing shares to employees below their fair market value can cause legal and financial problems for startups

- Keeping your cap table accurate will allow you to understand how future financing rounds or a potential acquisition will affect you and your employees ownership stake and payout

RELATED

What is a down round in startup financing?

Learn what a down round is, what causes it, its implications for a startup, the anti-dilution provisions, and the alternative measures to avoid it.

Written by Greg Miaskiewicz

Security expert, product designer & serial entrepreneur. Sold previous startup to Integral Ad Science in 2016, where he led a fraud R&D team leading up to a $850M+ purchase by Vista in 2018.

Related

Pre-Incorporation Checklist: 6 Steps Before Startup Incorporation

We cover all the important steps founders should take before incorporating their startup: choosing business entity, state of incorporation, name, board of directors, splitting equity between founders & more.

by Michał Kowalewski • 10 min read

by Michał Kowalewski • 10 min readWhat is Stock Dilution?

When a company authorizes new stock, the value of existing stock is reduced. Here's the why and how.

by Capbase Staff • 7 min read

by Capbase Staff • 7 min readHow Startup Equity Works: Common and Preferred Share Classes

Startups typically issue common shares to founders, employees, advisors and consultants; they issue preferred shares to investors as part of venture financing rounds The preferred class of stock in a startup is typically subdivided into series, each representing a different round of financing, like Series A, Series B, and so on.

by James Hottensen • 3 min read

by James Hottensen • 3 min read